Enterprise Risk Management

Risk Management is critical to the Group’s success in having sustainable profitable growth and reaching a top position in the future electric premium segment with access to international financial equity markets. The principles of Risk management are founded on the strategies and policies of the Group.

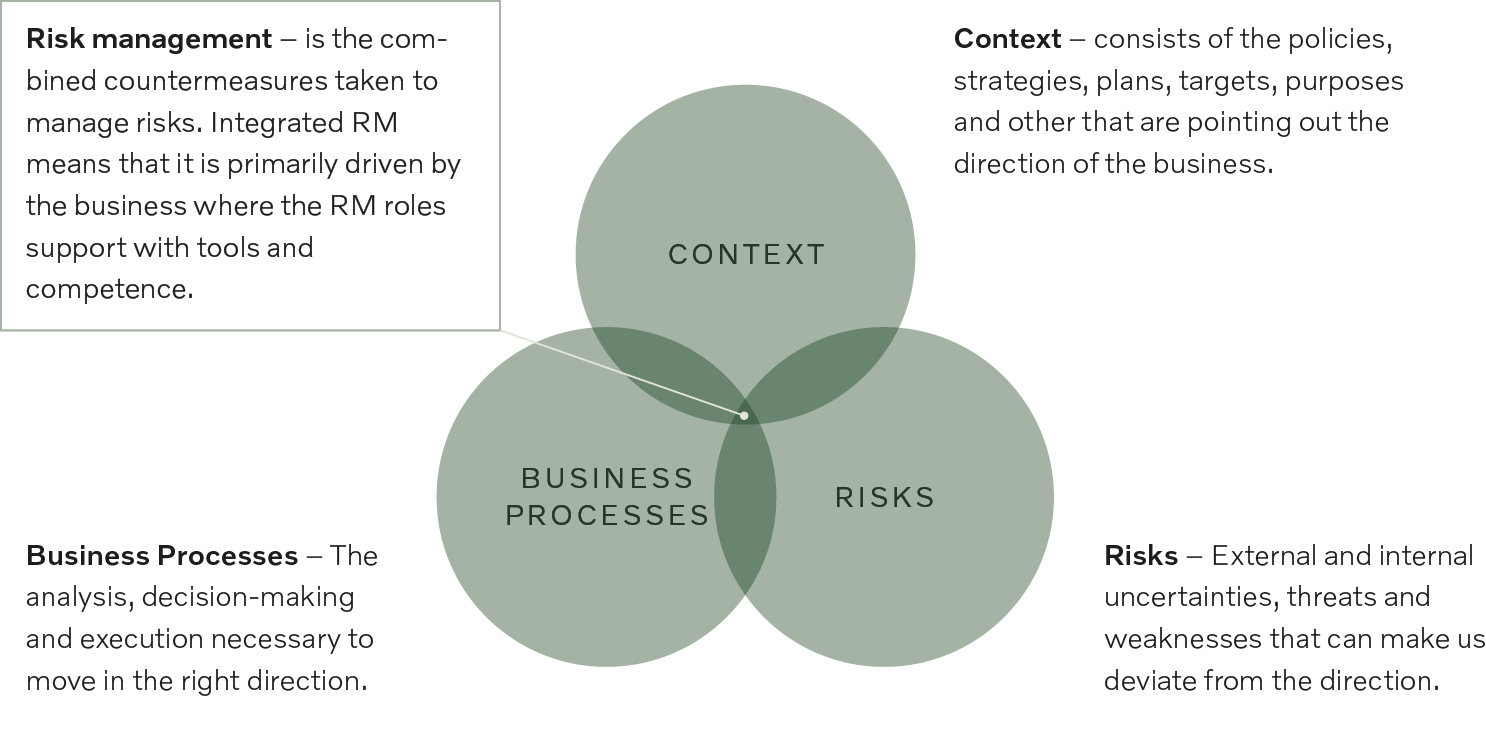

Enterprise Risk Management (ERM) is integrated in the business with an objective to improve decision making, proactively protect the fulfilment of strategies and plans and protecting our assets. The ERM also supports effective Business Continuity Management and transparency towards our external stakeholders. In addition, we want risk management to be driven by culture and leadership behaviours, integrated in our daily operation, and based on best practice way of working

Governance

The ultimate responsibility for ensuring risks (including climate related risks and opportunities) of Volvo Car Group are sufficiently managed lies with the Board of Directors.

The formal Enterprise Risk reporting process towards the Board occurs twice a year. Input is gathered throughout the organisation via the local risk managers, resulting in a comprehensive overview of risks in the organisation.

Risks are prioritised through collaboration in a cross functional team of Senior Managers. The top risks are presented to the Board of Directors and discussed by the Audit Committee twice a year. Additionally, the Internal Audit function serves as a 3rd line of defence by providing an objective review of the effectiveness of Risk Management all through the Group

Risk management principles and approach to risk

The risk management function at Volvo Car Group strives to be dynamic, iterative, and responsive to changes. Dynamic risk management means that we consider that the risk landscape changes rapidly, evolves, and integrates with other risks constantly. Iterative means that the risk management cycle is constantly active in our business. Our business context and business model constantly change, and risk management must be responsive to these changes. In addition, we want risk management to be driven by culture and leadership behaviours, integrated in our daily operation, and based on best practice way of working.

Approach to risk

Risk management at its core is based on what approach we choose to have for risks. At Volvo Car Group, the approach is dependent on the category of risk in question.

Risk drivers and accelerators

There are some key, more generic, factors that influence our business and drive risk. Individually, these are not considered risks, but rather drivers/ accelerators, which in combination with other factors can simultaneously accelerate the pace at which a risk is evolving or even create completely new risks.

Intelligence on the trends is gathered and used as a base for decisions on strategic direction. Intelligence is a crucial part of mitigating risks driven and/or accelerated by these various trends. More information about our industry and market trends can be found on pages 11-14, and our strategic work on pages 17-37.

More information in our Annual and Sustainability Report for 2022 - pages 54-58.